However, a short period of negative working capital may not be an issue depending on the company’s stage in its business life cycle and its ability to generate cash quickly. To find the change in Net Working increase in net working capital formula Capital (NWC) on a cash flow statement, subtract the NWC of the previous period from the NWC of the current period. This calculation helps assess a company’s short-term liquidity and operational efficiency.

- However, if the change in NWC is negative, the business model of the company might require spending cash before it can sell and deliver its products or services.

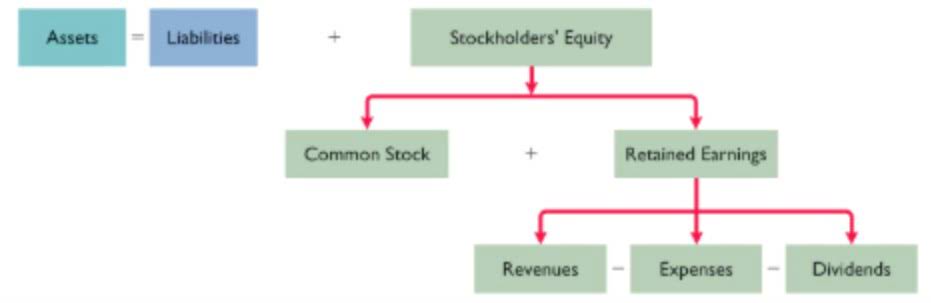

- The formula to calculate working capital—at its simplest—equals the difference between current assets and current liabilities.

- The net working capital ratio formula is $600,000 of current assets divided the $350,000 of current liabilities for a working capital ratio of 1.71.

- As a business owner, it’s important to calculate working capital and changes in working capital from one accounting period to another to clearly assess your company’s operational efficiency.

- If you’re seeking to increase liquidity, a stricter collection policy could help.

- Negative Net Working Capital indicates your company cannot cover its current debt and will likely need to secure loans or investment to continue operations and preserve solvency.

- The working capital formula and working capital ratio formulas are popular and easy ways to estimate your future cash flows.

Business is Our Business

Net working capital can offer insight into whether or not a company is able to meet its current financial obligations. By evaluating its current assets and liabilities, a company can determine if its NWC is positive or negative. Keep in mind, this calculation is only one of many ways in which a company’s financial situation can be evaluated. You should take into consideration limitations and other ratios when determining the overall financial position of your business.

Growth Rate

Net working capital, or sometimes just “working capital”, refers to short-term assets left after deducting short-term liabilities. In other words, it shows how much current assets the company would have left if it had to use them to settle all of its current liabilities. The net working capital formula is calculated by subtracting the current liabilities from the current assets. If the change in working capital is negative, it means that the change in the current operating assets has increased more than the current operating liabilities. Another way to measure working capital is to look at the working capital ratio, which is current assets divided by current liabilities. Generally, a working capital ratio of less than 1.0 is an indicator of liquidity problems, while a ratio higher than 2.0 indicates good liquidity.

Positive Impacts

Her expertise spans roles as a Credit Analyst, Loan Administrator, and Bank Teller, obtaining skills in commercial real estate, financial analysis, and banking operations. With a particular focus in small business financing, she has navigated financial solutions for a variety of lending institutions. It’s worth noting that if you make a major financial decision, such as taking out a loan or a lease for equipment, your NWC will be impacted in the near term. You can get a clearer picture of the financial trends of your business over time by assessing changes in NWC, which can be useful when making business decisions. My Accounting Course is a world-class educational resource developed by experts to simplify accounting, finance, & investment analysis topics, so students and professionals can learn and propel their careers. Understanding changes in cash flow is also important if you are applying for a small business loan.

Suppose we’re tasked with calculating the net working capital (NWC) of a company with the following balance sheet data. If your business is constantly struggling to maintain a healthy cash flow, you can improve your net working capital https://www.bookstime.com/ in a few ways. Don’t do anything that damages the long-term value of your company to juice short-term profit. They only exception to that rule is when you’re so tight on cash that the entire future of your company is questionable.

- To reiterate, a positive NWC value is perceived favorably, whereas a negative NWC presents a potential risk of near-term insolvency.

- It might indicate that the business has too much inventory or isn’t investing excess cash.

- This Site cannot and does not contain legal, tax, personal financial planning, or investment advice.

- For example, consider a manufacturing company facing challenges in collecting receivables from customers, leading to a significant increase in A/R.

- I list these and many others in my article on how to improve cash flow.

In doing so, it can promote future growth and allow for borrowing power should you apply for financing. That being said, while a business should have a positive NWC, an NWC that’s too high signifies a business that may not be investing its short-term assets efficiently. On the other hand, a negative NWC means that a company will typically need to borrow or raise money to remain solvent.

Refinance to Turn Short-Term Debt into Long-Term Debt

- Generally, a working capital ratio of less than 1.0 is an indicator of liquidity problems, while a ratio higher than 2.0 indicates good liquidity.

- First, the company can decrease its accounts receivable collection time.

- This is a sign of financial health, since it means the company will be able to fully cover its short-term obligations as they come due over the next year.

- A positive amount indicates that the company has adequate current assets to cover short-term obligations.

- This indicates the company lacks the short-term resources to pay its debts and must find ways to meet its short-term obligations.

A tighter, stricter policy reduces accounts receivable and, in turn, frees up cash. That comes at a potential cost of lower net sales since buyers may shy away from a firm that has highly strict credit policies. For many firms, the analysis and management of the operating cycle is the key to healthy operations. The working capital cycle formula is days inventory outstanding (DIO) plus days sales outstanding (DSO), subtracted by days payable outstanding (DPO).

Increase Your Inventory Turnover Ratio.

A business has negative working capital when it currently has more liabilities than assets. This can be a temporary situation, such as when a company makes a large payment to a vendor. However, if working capital stays negative for an extended period, it can indicate that the company is struggling to make ends meet and may need to borrow money or find another way to finance their working capital. One common financial ratio used to measure working capital is the current ratio, a metric designed to provide a measure of a company’s liquidity risk.

Current Assets

Expanding without taking on new debt or investors would be out of the question and if the negative trend continues, net WC could lead to a company declaring bankruptcy. A positive calculation shows creditors and investors that the company is able to generate enough from operations to pay for its current obligations with current assets. A large positive measurement could also mean that the business has available capital to expand rapidly without taking on new, additional debt or investors. Working capital is also important if you are trying to woo an investor or get approved for a small business loan.